The global fintech market is expected to reach $305 billion by 2025. Fintech solutions have become an integral part of our lives, changing the way we bank, pay for goods and services, and borrow money.

Financial institutions are also adapting to the changing landscape, developing new products and services to meet the needs of consumers. As society becomes more digital, new fintech trends are emerging that will shape the future of the industry.

1. Embedded Finance

One of the most significant trends is the growth of embedded finance. Embedded finance refers to the integration of financial services into non-financial platforms. This is driven by consumer demand for convenience and flexibility. For example, BNPL (buy now, pay later) options are now available on many e-commerce sites. This allows consumers to make a purchase now and pay for it later, without having to go through the traditional process of applying for a loan. Embedded payments are another example of embedded finance. These payments eliminate the need to enter credit card details for every purchase. The relevant information is already stored on the platform.

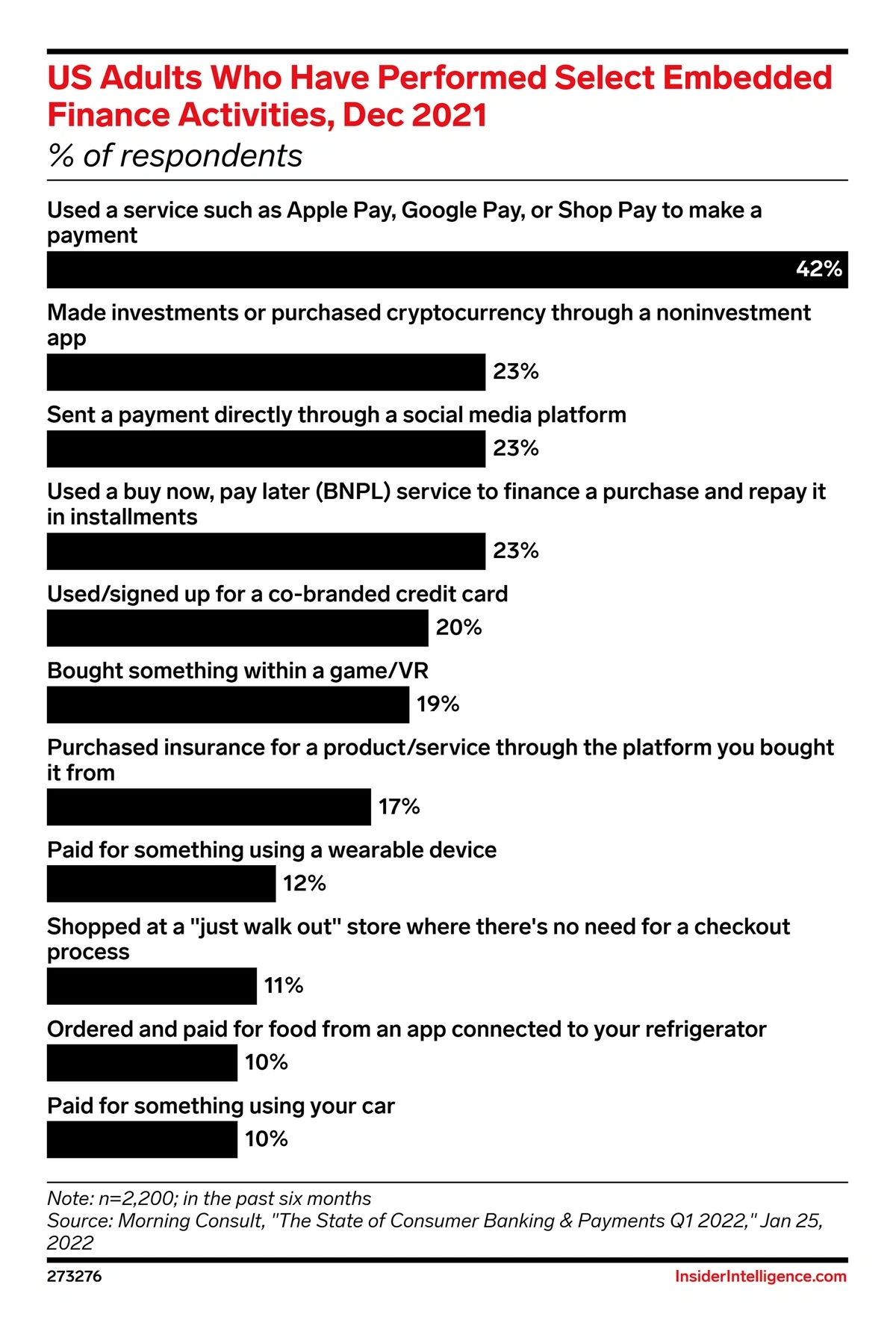

The embedded finance market is currently worth $63.2 billion, and it is expected to grow to over $248 billion by 2032. Investors have also taken notice of this trend, with venture capital investments in embedded finance reaching $4.25 billion in 2021. Digital wallets are one of the most popular embedded finance tools. According to Insider Intelligence, 42% of Americans have used a digital wallet, and a similar percentage have used BNPL services or transferred funds via social media.

2. Regtech Solutions: Precision and Efficiency for Compliance

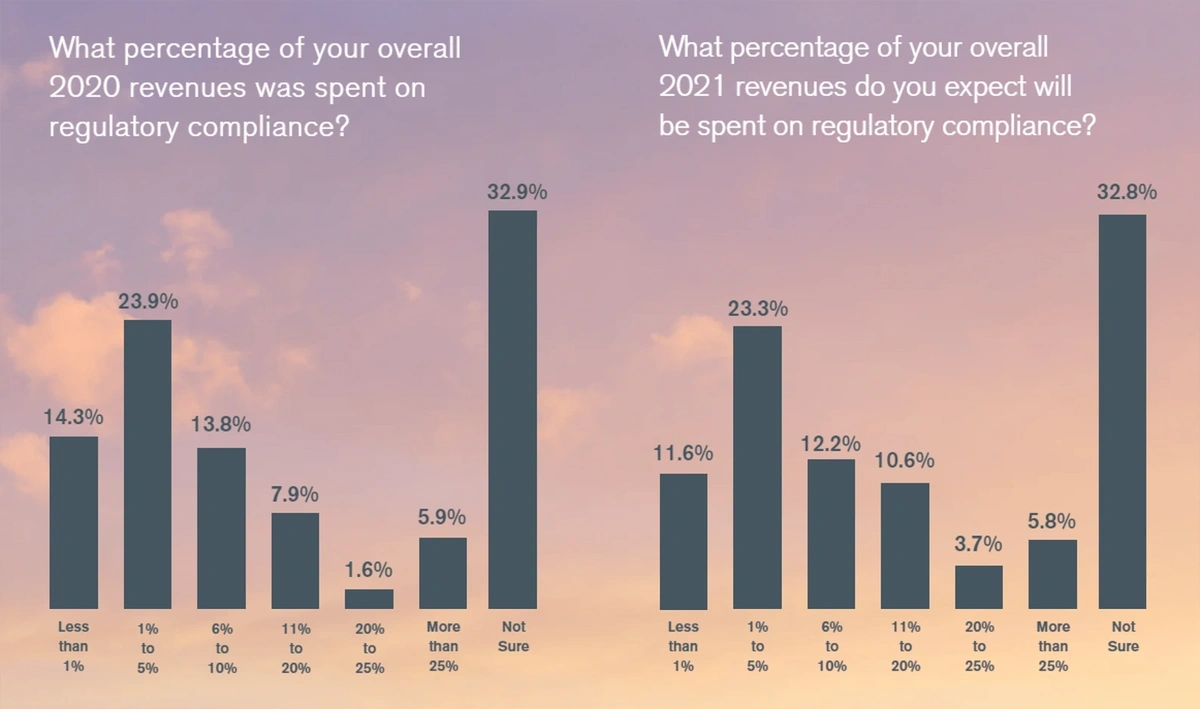

Regtech streamlines complex data handling in financial institutions, replacing manual efforts. These solutions employ cloud tech, machine learning, and data analytics to preempt risks and ensure adherence to regulations, yielding efficiency and accuracy. Expected 200% growth in the Regtech sector (2022-2026) drives financial institutions to invest, aiming for cost savings.

Globally, financial crime compliance costs hit $213.9 billion in 2021. Non-compliance penalties, like JP Morgan’s $125 million fine in 2021, underscore the importance. Regtech’s impact is evident in Australian banks: hours of manual work reduced to 2.5 minutes with AI-powered Ascent.

3. Automating Routine Tasks with Robotic Process Automation

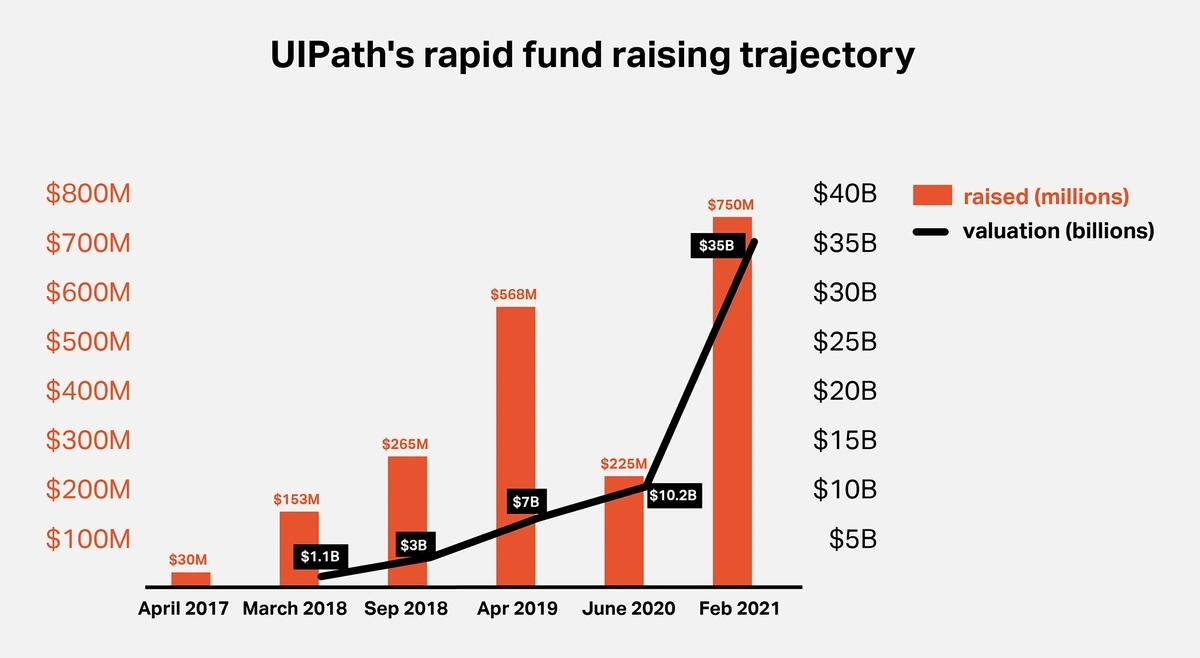

Financial institutions are increasingly adopting Robotic Process Automation (RPA) to optimize efficiency and cut costs. RPA, often termed “software robotics,” is tailored for automating repetitive, rule-based tasks that are time-consuming but don’t require human cognitive input. Predicted to grow at a 38.2% CAGR from 2022 to 2030, RPA’s substantial expansion is projected in the banking, financial services, and insurance sectors, which constituted almost 30% of the total market in 2021.

Gartner highlights that 80% of finance leaders have either integrated or planned to incorporate RPA solutions, which are harnessed for diverse tasks such as customer behavior insights, invoice analysis, and fraud prevention. By 2024, Gartner envisions CFOs utilizing hyper-automation and process redesign to achieve a 30% reduction in operational costs. Key players in the field include UiPath, valued at $35 billion in 2021, and Automation Anywhere, offering RPA-as-a-Service. Notably, Patelco Credit Union’s successful implementation of RPA led to an 88% processing time reduction, 62% efficiency gain, and $39,000 yearly savings through automated fraud alerts amidst 11% year-over-year member growth.

4. Fintech Enterprises Combine Financial Solutions with Environmental Focus

Fintech companies are capitalizing on the increasing demand for environmentally sustainable practices by integrating finance solutions with green initiatives. Despite only 8% of fintech founders identifying as “sustainable fintech,” investor interest in this sector is strong. Venture capital investment in green fintech doubled between 2020 and 2021, reaching over $40 billion across 600 venture deals. Notably present in countries like Switzerland, Spain, Singapore, and Sweden, green fintech startups are making a global impact.

An illustration is Trine, a Swedish company facilitating loans to solar energy providers delivering renewable energy to underserved areas via a peer-to-peer platform similar to GoFundMe. Joro caters to eco-conscious consumers, utilizing personalized data and emissions information to estimate individual carbon footprints. Stripe, a major financial player, launched Stripe Climate, enabling businesses to direct revenue toward carbon removal. Their commitment to the carbon-capture market, alongside other corporations, amounts to $1 billion, supplemented by Frontier’s $925 million initiative for permanent carbon removal by 2040.

5. Persistent Popularity and Lingering Concerns: The Buy Now, Pay Later Phenomenon

Buy Now, Pay Later (BNPL) services’ popularity has surged, reaching a $120 billion market value in 2021 with an 85% CAGR between 2019 and 2021. While over half of Americans have embraced BNPL, about 40% of non-users plan to adopt it within six months, as per a survey by The Ascent. However, concerns persist. Around 17% of respondents anticipate being late on BNPL payments in the next year, and 18% view this likelihood. Accrue Savings’ study reveals that 28% of Gen Z and 22% of Millennials often overspend, contributing to 44% of BNPL users missing payments.

Complexities in understanding BNPL and credit cards are evident, with a J.D. Power survey showing that 38% of 18 to 44-year-olds partially understand these methods. Regulatory actions are underway, as the Consumer Financial Protection Bureau (CFPB) investigates debt and data concerns. Despite these challenges, key players like Affirm are expanding offerings, launching services like Affirm Debit+ for flexible payments.

6. Banking Sector Commences Witnessing Cost Savings Driven by AI

The banking sector is increasingly embracing AI-driven solutions to achieve cost savings and operational efficiency. This trend spans customer service chatbots, fraud prevention, and more, leading to a projected $64 billion market for AI adoption by 2030, with a CAGR of 32% from 2021 to 2030, according to Allied Market Research. Around 80% of financial institutions recognize AI’s benefits, and over 60% expect AI to become mainstream in banking within two years. Already, 45% have adopted AI technology.

Autonomous NEXT predicts AI could reduce financial service operating costs by 22% ($1 trillion equivalent) by 2030. Key areas for AI impact include conversational banking, fraud detection, risk management, and underwriting. Automating middle-office tasks could save North American banks $70 billion by 2025.

Socure utilizes AI for digital identity verification and fraud prevention, significantly reducing false positives and manual reviews. Despite a workforce reduction, the company’s customer base grew rapidly, contributing to a $4.5 billion valuation. Accenture reports that AI could increase customer interactions 2-5x, benefiting both customers and banks by understanding preferences, predicting churn, and anticipating customer acceptance.

Gila’s digital customer service platform serves 250+ banks, offering unified communication channels and AI-powered self-service options. In 2022, Gila secured $45 million in funding, achieving a $1 billion valuation.

7. Growing Enthusiasm Observed Among Employees for On-Demand Pay

Fintech is reshaping payroll practices, extending beyond consumer transactions to business payments. The rise of on-demand pay, also known as earned wage access, is a notable trend within this shift. Fintech solutions enable companies to offer cloud-based platforms, granting employees the ability to check their payroll balance and withdraw funds through an app whenever needed.

In 2020, US workers accessed $9.5 billion through such platforms, tripling the amount from 2018. Rapid wage access is particularly important for financially stressed employees, with 35% experiencing difficulties between pay periods in a US and UK survey.

Around 20% of respondents expressed interest in using on-demand pay options, and 80% of workers prefer employers offering this feature, as noted by ADP. Enhanced loyalty and reduced turnover are reported benefits. Leading in this field, DailyPay serves 80% of Fortune 200 companies, managing over $2 billion in earnings, and its service saves employees $1,250 yearly, recognized by TIME Magazine as a top invention.

However, on-demand pay’s popularity is accompanied by concerns about associated fees. Some solutions charge users for accessing their earned yet unpaid income, raising comparisons to payday lending – for instance, DailyPay imposes a $2.99 fee.

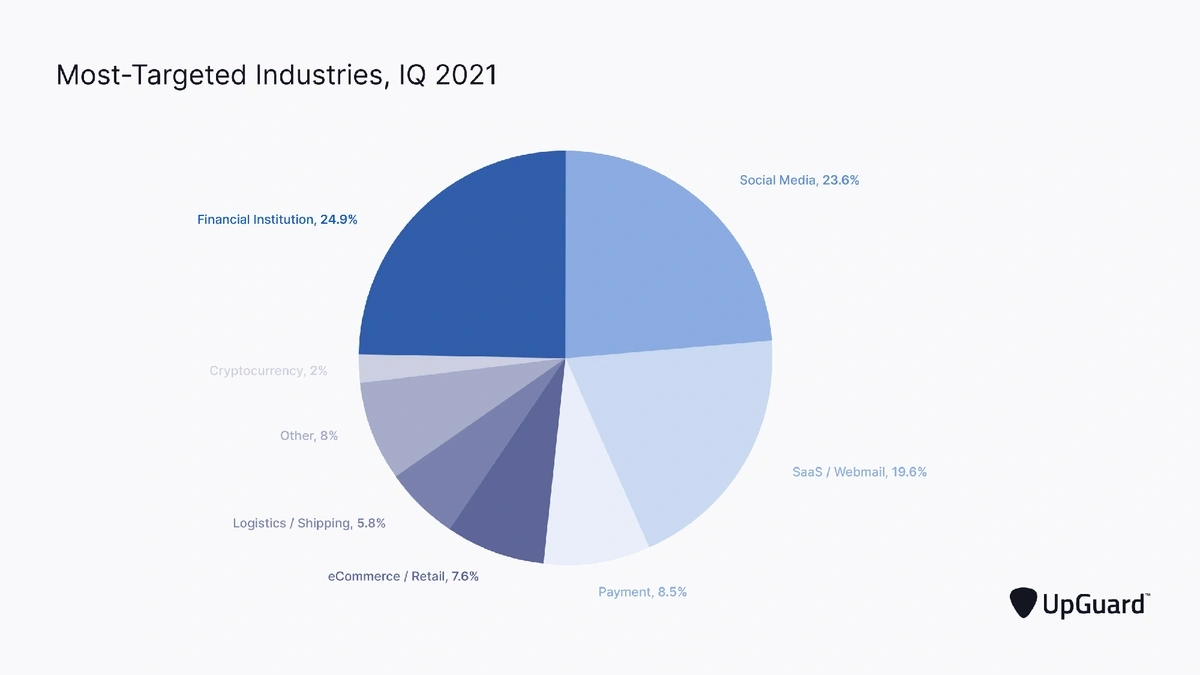

8. Emerging Strategies Employed by Cybercriminals to Attain Funds and Data Access

The financial sector faces escalating cybersecurity threats as revealed by Trend Micro, a global cybersecurity firm. Notably, ransomware attacks in the banking industry surged by a staggering 1,318% between 2020 and 2021. The finance domain was the primary target for phishing attacks during Q1 2021, with phishing attacks in the sector increasing by 22% in H1 2021 compared to 2020, along with a 38% rise in attacks targeting financial apps.

The financial industry bears substantial financial losses due to these threats. Each data breach costs approximately $4.2 million, as per IT professionals surveyed in the financial sector. Cybercriminals continuously devise innovative tactics to circumvent security measures. Among these tactics, the use of “deep fake” techniques is notable, employing AI and machine learning to replicate individuals’ voices and appearances.

Instances of deep fake attacks include incidents where criminals mimicked executive voices to fraudulently transfer funds. Another method involves the Trojan “Fake calls,” which impersonates popular bank apps, allowing hackers to manipulate phone calls and extract confidential data.

Furthermore, cybercriminals now target banks’ AI and machine learning systems, exploiting vulnerabilities in these complex analytics tools. As the security tools for safeguarding these systems are still evolving, hackers exploit this gap, potentially gaining the upper hand.

9. Rapid Increase in the Adoption of Biometrics

Federal Reserve Chairman Jerome Powell emphasized cyberattacks as the foremost risk to the global financial system in 2021. Fintech firms are responding to this severe threat by implementing innovative security measures. Password-less authentication gains prominence, with almost 90% of security leaders considering it the most secure option, as per a HYPR-commissioned survey.

This approach includes methods like sending users a push notification for an authentication code, or utilizing biometrics such as fingerprints, faces, and voiceprints. Voiceprint technology, capable of analyzing intricate voice characteristics for identity verification, shows promise. Pindrop’s voiceprint platform was embraced by The First National Bank of Omaha, leading to substantial benefits in customer service and fraud reduction.

Furthermore, behavioral biometrics are employed to monitor fraud during users’ sessions. These machine learning systems observe physical and cognitive actions, discerning legitimate from malicious behavior. A major credit card issuer adopting behavioral biometrics achieved a 90% increase in fraud detection and a 12x return on investment through streamlined applications, reduced costs, and lowered fraud instances.

10. Neobanks Attract the Interest of Younger Generations

The adoption of biometrics is rapidly growing, particularly among young consumers in the US, who are increasingly favoring digital banks like PayPal and Chime as their primary checking account providers over traditional banks. According to FICO, the preference for fintech options over traditional banks among young consumers has doubled since 2020. Only 25% of Gen Z now use major banks for their primary checking.

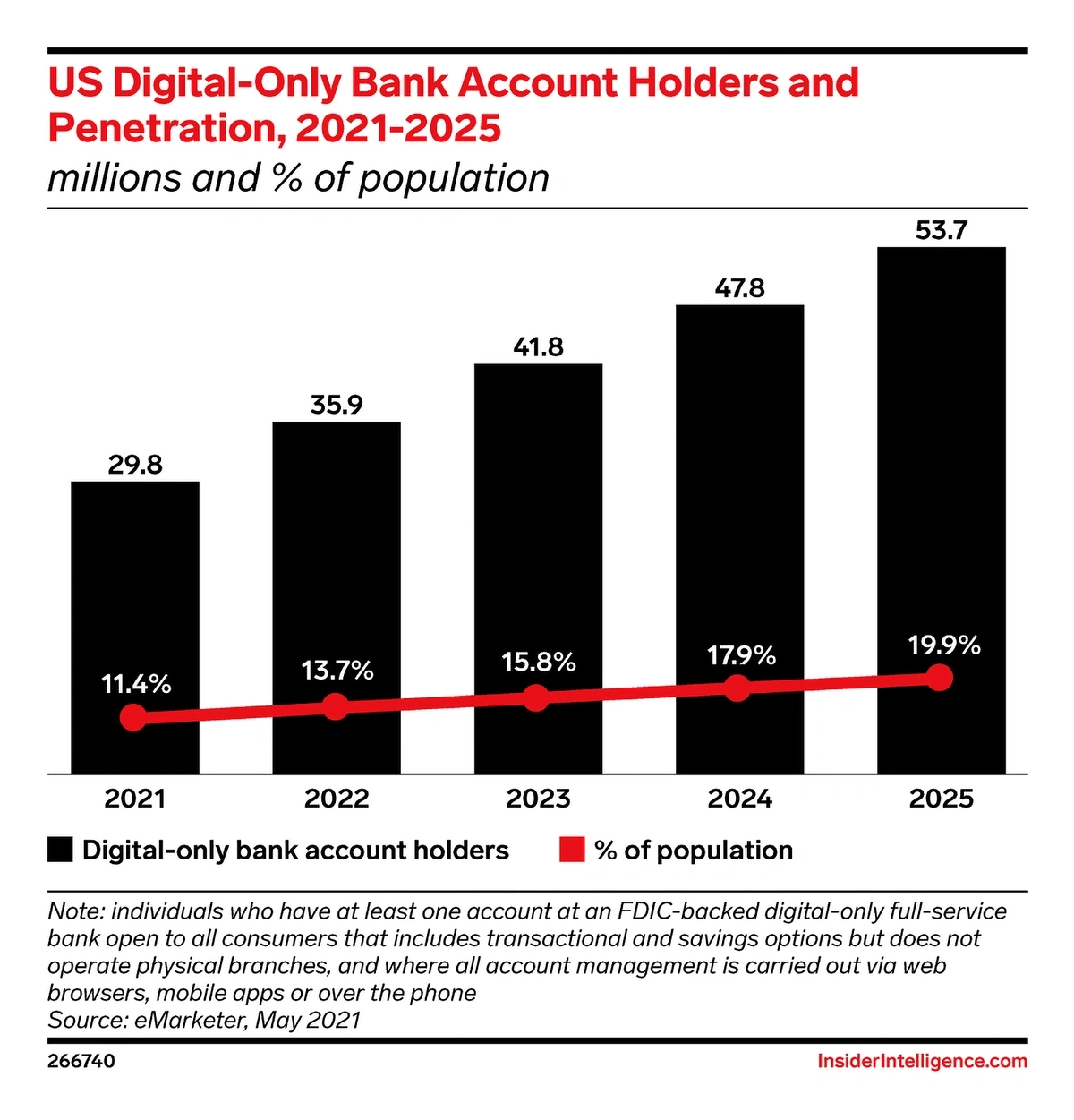

Neobanks or challenger banks, which are digital-only banking platforms, are gaining traction. As of July 2022, there are around 350 neobanks globally. Bloomberg reports that there were 80 million Neobank customers in North America and Europe in 2021, projected to reach 224 million by 2026. Neobanks’ revenue is expected to grow by 580% during this period. Insider Intelligence predicts that the US alone will have around 53.7 million Neobank account holders by 2025.

The appeal of Neobanks lies in their seamless digital experiences, featuring bot-powered customer service, social media integration, and streamlined account setup. Chime, the largest Neobank in the US with over 12 million customers and a 58.6% market share, offers attractive features like no fees, automatic savings, and quick account opening.

However, Neobanks are facing challenges, including increasing regulatory scrutiny. Chime, for instance, had to adjust its marketing after regulators questioned its use of the term “bank.” Additionally, experts caution that the business models of many neobanks may be unsustainable due to heavy reliance on interchange fees, with fewer than 5% reportedly breaking even according to Simon, Kucher & Partners.

Conclusion

Concluding our compilation are these 10 notable trends in the current fintech landscape. As we navigate this digital-centric era, various financial services are in a race to adjust. The institutions poised for success are those embracing technology to enhance efficiency, sidestep security pitfalls, and accommodate evolving consumer preferences.